Harshad Mehta Biography: The Big Bull of Indian Markets

Harshad Mehta, born July 29, 1954, in Paneli Moti, Gujarat, was a stockbroker whose meteoric rise and infamous 1992 securities scam shook India’s financial world. Known as the “Big Bull,” Harshad Mehta manipulated stock markets, earning both fame and infamy. This biography dives into his early life, career highlights, struggles, controversies, personal life, social media presence, philanthropy, and lesser-known facts, reflecting his complex legacy in 2025.

About Harshad Mehta

| Category | Details |

|---|---|

| Full Name | Harshad Shantilal Mehta |

| Born | July 29, 1954, Paneli Moti, Rajkot, Gujarat, India |

| Died | December 31, 2001, Thane, Maharashtra, India |

| Profession | Stockbroker, Businessman |

| Notable Work | 1992 Indian Securities Scam, GrowMore Research and Asset Management |

| Marital Status | Married to Jyoti Mehta |

| Children | Son: Atur Mehta |

| Net Worth | ~₹5,000 crore at peak (1992); assets seized post-scam |

| Awards | None; known for nickname “Big Bull” |

Harshad Mehta’s Early Life

Humble Beginnings

Born into a Gujarati Jain family, Harshad Mehta grew up in a modest household in Paneli Moti, Rajkot. His father, Shantilal Mehta, ran a small textile business. The family later moved to Mumbai’s Borivali, where financial struggles shaped Harshad’s ambition. He attended Janta Public School in Bhilai and showed no early academic brilliance but loved cricket.

Path to Mumbai

After schooling, Harshad moved to Mumbai, enrolling at Lala Lajpatrai College for a B.Com degree, completed in 1976. For eight years, he took odd jobs, selling hosiery, cement, and sorting diamonds. His interest in stocks sparked while working at New India Assurance Company, leading him to quit and join a brokerage firm in 1981.

Struggles and Down Phases

Early Career Challenges

Before fame, Harshad Mehta faced financial hardship. His father’s stroke left the family unable to afford cremation costs. Harshad’s early ventures, including sales jobs, offered little success. Moreover, his lack of formal financial training made breaking into Mumbai’s stock market tough, as he competed with seasoned brokers.

Post-Scam Fallout

The 1992 scam exposure brought Harshad’s empire crashing down. Arrested by the CBI, he faced 72 criminal charges and over 600 civil suits. His lavish lifestyle ended with asset seizures, including his Worli penthouse. Imprisoned in Tihar Jail, he died in 2001, leaving his family to fight ongoing legal battles.

Career Highlights

Rise to Fame

In 1984, Harshad became a Bombay Stock Exchange (BSE) member, founding GrowMore Research and Asset Management in 1986. By 1990, he drove stock prices, like Associated Cement Company (ACC), from ₹200 to ₹9,000, earning the “Big Bull” title. His “replacement cost theory” justified inflated valuations, attracting elite investors.

The 1992 Scam

Harshad masterminded the 1992 securities scam, siphoning ₹4,000 crore from banks using fake receipts in “ready forward” deals. This fueled a BSE Sensex surge from 1,000 to 4,500 points. However, journalist Sucheta Dalal’s exposé in April 1992 unraveled the fraud, causing a market crash and exposing banking loopholes.

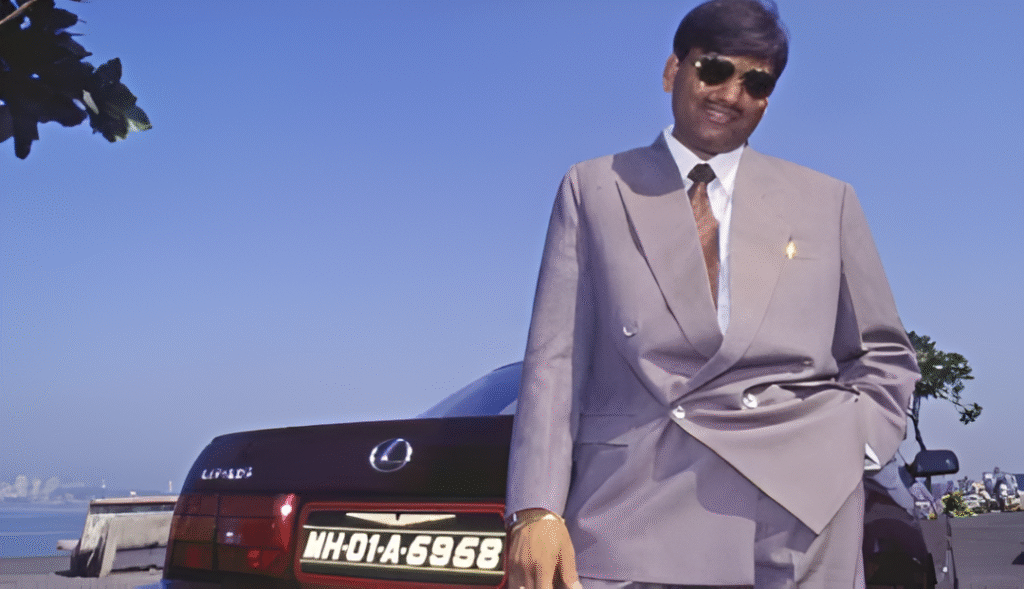

Personal Life

Harshad married Jyoti Mehta, a homemaker, and had a son, Atur Mehta. He lived lavishly in a 15,000 sq. ft. Worli penthouse with a pool and mini-theater. A car enthusiast, he owned a Lexus LS 400, rare in 1990s India. After his death, Jyoti and Atur fought legal battles to reclaim assets.

Controversies

1992 Securities Scam

The Harshad Mehta scam, valued at ₹30,000 crore (2023 terms), involved fake bank receipts to manipulate stock prices. It defrauded investors and crashed the BSE by 43%. Harshad was convicted on four of 27 charges. His family claims he was scapegoated for systemic flaws.

Political Allegations

In 1993, Harshad alleged paying ₹1 crore to then-Prime Minister P.V. Narasimha Rao to influence his case. The claim, backed by lawyer Ram Jethmalani, was unproven, sparking political uproar. Additionally, his ties to bank officials and brokers like Hiten Dalal fueled controversy.

Social Media Presence

Harshad died before social media’s rise, so he had no personal accounts. However, his legacy thrives online. The 2020 web series Scam 1992 on SonyLIV, based on Sucheta Dalal’s book, boosted his fame. On X, fans like @price_trader_ celebrate his birthday, calling for “Big Bull Day.” Hashtags like #HarshadMehta trend, with posts debating his genius versus fraud.

Lesser-Known Facts

- Cricket Lover: Played as a left-arm spinner in college.

- Self-Taught: Learned stock trading without formal training.

- Luxury Cars: Owned 15–20 cars, including a Toyota Corolla.

- Media Star: Lent his Worli penthouse for photoshoots.

- Book Author: Started writing The Dream Merchant before his death.

- Tax Record: Paid ₹24 crore in taxes in 1992, a record then.

- Family Struggles: His mother, Rasilaben, died in 2020 amid legal battles.

- Legal Legacy: His wife, Jyoti, won ₹524 crore in a 2018 lawsuit.

Philanthropy

No public record confirms significant philanthropy by Harshad Mehta. His wealth focused on personal luxury, and post-scam asset seizures limited charitable efforts. His family, particularly Jyoti and Atur, prioritized legal battles over philanthropy, though they supported education for relatives, reflecting the family’s value on learning.

Current Status and Influence

Harshad Mehta died on December 31, 2001, from a heart attack in Thane Jail, aged 47. His son, Atur, and wife, Jyoti, live privately, possibly in the U.S., managing ongoing lawsuits. The 1992 scam led to SEBI reforms, modernizing India’s markets. In 2025, Harshad’s story, dramatized in Scam 1992, remains a cautionary tale of ambition and greed.

Conclusion

This Harshad Mehta biography traces a rollercoaster life. From a struggling Gujarati boy to the “Big Bull,” Harshad Mehta reshaped India’s stock market before his 1992 scam led to a dramatic fall. His legacy, marked by controversy and reform, captivates audiences through media like Scam 1992. In 2025, his story warns against unchecked ambition while inspiring market enthusiasts.