Radhakishan Damani Biography: Building a Retail Empire

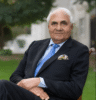

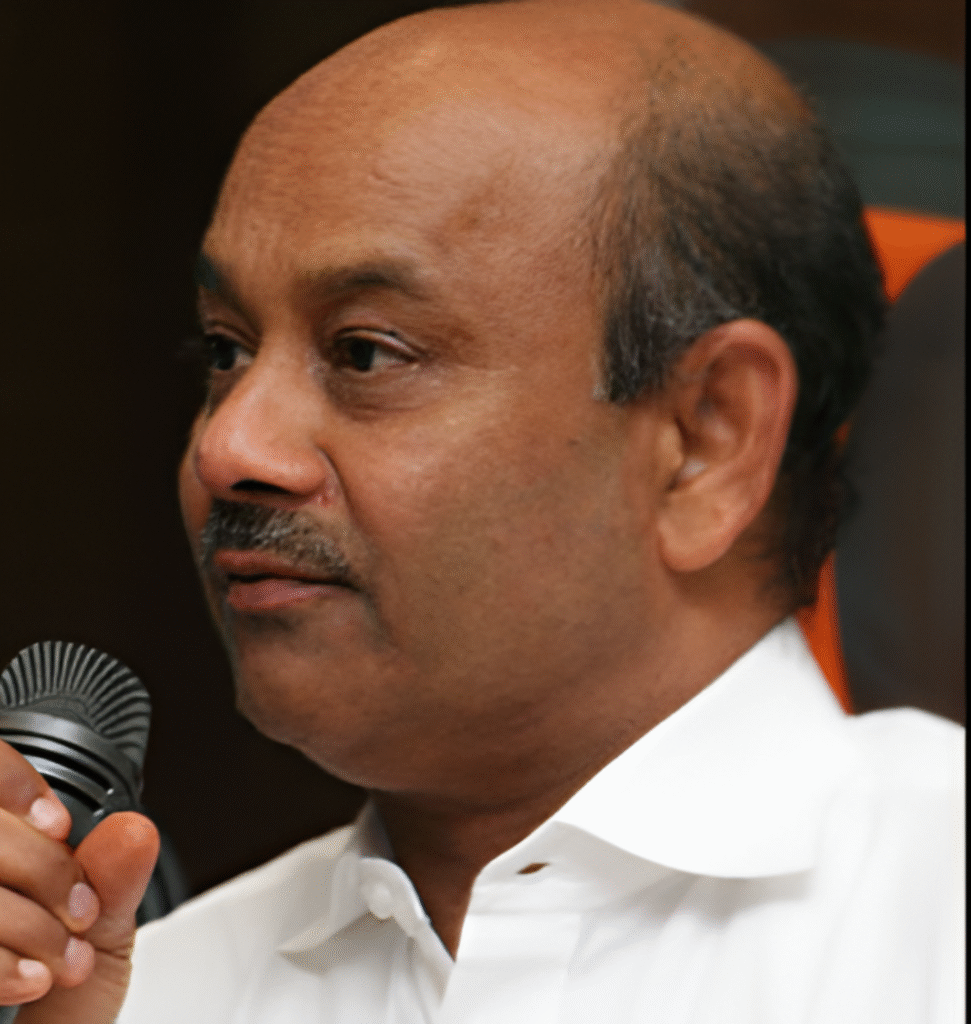

Radhakishan Damani, born in 1954 in Bikaner, Rajasthan, is a billionaire investor and founder of DMart, India’s leading retail chain under Avenue Supermarts. Known as the “Retail King,” Radhakishan Damani transformed India’s retail landscape with his low-cost, high-value model. This biography explores his early life, career highlights, struggles, controversies, philanthropy, social media presence, and lesser-known facts as of July 2025.

About Radhakishan Damani

| Category | Details |

|---|---|

| Full Name | Radhakishan Shivkishan Damani |

| Born | 1954, Bikaner, Rajasthan, India |

| Profession | Businessman, Investor, Founder of Avenue Supermarts (DMart) |

| Notable Work | DMart, Investments in VST Industries, India Cements, Blue Dart |

| Marital Status | Married to Shrikantadevi Damani |

| Children | Three daughters: Manjri, Jyoti, Radhika |

| Net Worth | ~$15.1 billion (December 2024) |

| Awards | Padma Shri (2021), Economic Times Business Leader (2017) |

Radhakishan Damani’s Early Life

Modest Marwari Roots

Born into a Maheshwari Marwari Hindu family, Radhakishan Damani grew up in a one-room apartment in Mumbai. His father, Shivkishanji, was a stockbroker on Dalal Street, exposing young Radhakishan to markets. Despite this, he initially showed little interest in stocks, focusing on small businesses.

Education and Early Ventures

Radhakishan studied commerce at the University of Mumbai but dropped out after a year. He ventured into a ball-bearing business, which struggled. At 32, his father’s sudden death forced him to join the family’s stockbroking business, marking his entry into the financial world.

Struggles and Down Phases

Early Business Failures

Radhakishan’s ball-bearing venture faced losses, leaving him in debt. The shift to stockbroking was challenging, as he lacked experience. Moreover, the competitive Dalal Street environment tested his patience, requiring years of observation to master trading.

Market Risks

In the 1990s, Radhakishan Damani took bold risks short-selling stocks during the Harshad Mehta scam. While profitable, this move carried high stakes, as market volatility could have led to significant losses. The 2001 Ketan Parekh scam further strained his portfolio, but his cautious approach minimized damage.

Career Highlights

Stock Market Mastery

Radhakishan became a stock market legend by short-selling overpriced stocks during the 1992 Harshad Mehta scam, earning substantial profits. He reportedly became HDFC Bank’s largest individual shareholder post its 1995 IPO. His mentor, Manu Manek, taught him strategic shorting, shaping his investment style.

Founding DMart

In 2002, Radhakishan Damani founded Avenue Supermarts, opening the first DMart store in Mumbai’s Powai. Focusing on low prices and quality, DMart grew to over 380 stores by 2025. The 2017 IPO, listed at a 102% premium, made Avenue Supermarts India’s most valuable retail stock, with a $36 billion market cap.

Personal Life

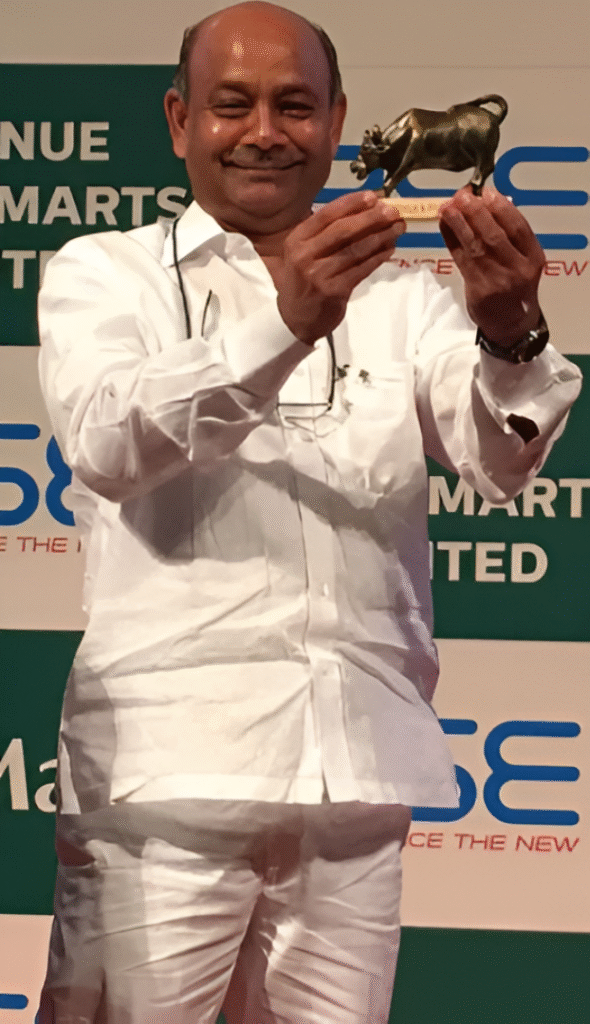

Radhakishan is married to Shrikantadevi Damani and has three daughters: Manjri, Jyoti, and Radhika. Known for his simplicity, he wears his trademark white shirt and trousers. He lives in Mumbai, avoiding the spotlight, and enjoys time with family. His brother, Gopikishan, is a business partner.

Controversies

Stock Market Criticism

Radhakishan’s aggressive short-selling in the 1990s drew criticism from brokers favoring bullish trends, like Harshad Mehta. His group, “Triple-R,” with Rakesh Jhunjhunwala, faced accusations of manipulating bearish trends. However, no legal violations were proven.

Health & Glow Acquisition

In 2023, Radhakishan Damani acquired Health & Glow for ₹750 crore, sparking debates about market consolidation. Critics argued it could limit competition in India’s beauty sector, projected to hit $17.4 billion by 2025. Damani defended the move as a growth strategy.

Philanthropy

Through the Damani Foundation, Radhakishan supports education and healthcare. He funds schools and hospitals in rural Maharashtra and Rajasthan. In 2020, he donated ₹100 crore to COVID-19 relief via the PM Cares Fund. Additionally, his foundation sponsors vocational training for underprivileged youth, impacting thousands.

Social Media Presence

Radhakishan avoids personal social media accounts, maintaining a low profile. Avenue Supermarts’ official X account (@DMartIndia) and Instagram (@dmartindia) share updates on his vision, reaching over 150,000 followers. His brother Gopikishan occasionally posts about DMart’s milestones on LinkedIn.

Lesser-Known Facts

- Mentor to Jhunjhunwala: Guided Rakesh Jhunjhunwala, India’s “Big Bull,” in stock trading.

- White Wardrobe: Earned the nickname “Mr. White and White” for his all-white attire.

- Early Investor: Bought HDFC Bank shares at ₹40, now trading at ₹2,600 (2020).

- Hospitality Ventures: Owns the 156-room Radisson Blu Resort in Alibag.

- Real Estate: Purchased 28 luxury apartments in Mumbai for ₹1,238 crore in 2023.

- Crisis Support: Helped small investors during the 2001 Ketan Parekh scam.

- Stock Picks: Invested in VST Industries at ₹80, now at ₹3,600 (2020).

- Low Profile: Rarely gives interviews, preferring work to speak for itself.

- Book Lover: Enjoys reading business and philosophy books.

Current Status and Influence

As of July 2025, Radhakishan Damani ranks sixth on Forbes India’s Rich List with a $15.1 billion net worth. His portfolio, worth ₹165,437 crore, includes stakes in 13 companies like VST Industries, Blue Dart, and Sundaram Finance. DMart operates over 380 stores, generating ₹11,569 crore in Q3 2024 revenue. His 2024 sale of India Cements to Kumar Birla for $1 billion shows strategic portfolio management. Damani’s value-investing approach influences India’s retail and stock market trends.

Conclusion

This Radhakishan Damani biography highlights a journey of resilience and strategy. From a college dropout to India’s Retail King, Radhakishan Damani overcame early failures to build DMart’s $36 billion empire. His philanthropy and investments inspire millions. In 2025, his disciplined approach continues to shape India’s retail and financial landscapes.