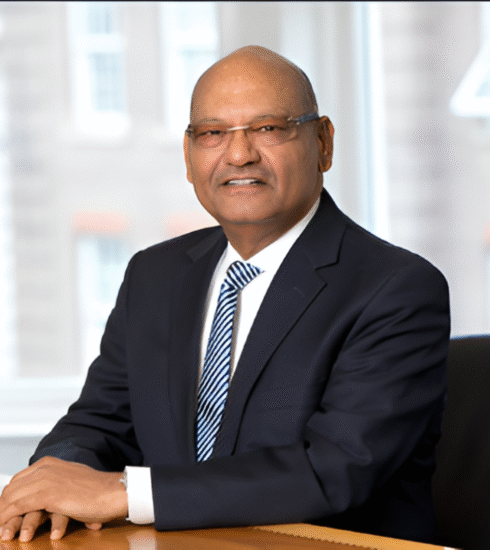

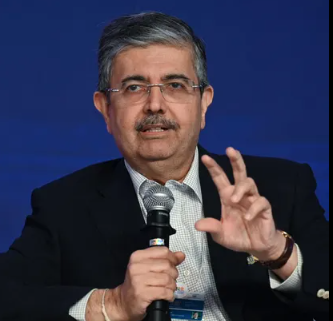

Uday Kotak Biography: Redefining India’s Banking Sector

Uday Kotak, born March 15, 1959, in Mumbai, India, is a billionaire banker and founder of Kotak Mahindra Bank, India’s fourth-largest private sector bank. Known for his visionary leadership, Uday Kotak transformed a small finance firm into a financial powerhouse. This biography explores his early life, career highlights, struggles, controversies, philanthropy, social media presence, and lesser-known facts as of July 2025.

About Uday Kotak

| Category | Details |

|---|---|

| Full Name | Uday Suresh Kotak |

| Born | March 15, 1959, Mumbai, Maharashtra, India |

| Profession | Banker, Founder of Kotak Mahindra Bank, Non-Executive Director |

| Notable Work | Kotak Mahindra Bank, ING Vysya Acquisition, Kotak811 Digital Bank |

| Marital Status | Married to Pallavi Kotak (1985) |

| Children | Jay Kotak, Dhawal Kotak |

| Net Worth | ~$15.87 billion (December 2024) |

| Awards | Padma Bhushan (2020), Ernst & Young Entrepreneur (2014) |

Uday Kotak’s Early Life

Growing Up in Mumbai

Born into an upper-middle-class Gujarati Hindu Lohana family, Uday Kotak grew up in a joint household with 60 relatives in Mumbai’s Babulnath. His father, Suresh, ran a cotton trading business with offices in Shanghai and Karachi pre-Partition. This environment blended “capitalism at work and socialism at home,” shaping his values.

Education and Interests

Uday attended Hindi Vidya Bhavan, excelling in mathematics and cricket. A forehead injury during a 1979 Kanga League match halted his cricket aspirations, requiring surgery and a year-long break from his MBA at Jamnalal Bajaj Institute of Management Studies. He also played the sitar, showcasing his diverse talents.

Struggles and Down Phases

Early Financial Risks

In 1985, Uday Kotak launched Kotak Capital Management with just ₹30 lakh borrowed from family and friends. The closed Indian economy and fierce competition posed challenges. Early ventures, like bill discounting for Tata’s Nelco, carried high risks with modest returns.

Surviving Crises

The 1997-98 Asian financial crisis hit non-banking financial companies hard, but Kotak Mahindra survived by halving its balance sheet. In 2024, the RBI banned Kotak Mahindra Bank from onboarding new online customers and issuing credit cards due to IT governance issues, causing a 13% stock drop.

Career Highlights

Founding Kotak Mahindra

In 1985, Uday started Kotak Capital Management, later renamed Kotak Mahindra Finance after Anand Mahindra’s investment. By 2003, it became India’s first non-banking finance company to receive an RBI banking license, transforming into Kotak Mahindra Bank.

Major Acquisitions

In 2014, Uday sealed a $2.4 billion acquisition of ING Vysya Bank, boosting Kotak Mahindra’s market share. The bank expanded into insurance, mutual funds, and digital banking with Kotak811. By 2025, it manages $68 billion in assets and operates 1,752 branches.

Personal Life

Uday married Pallavi Kotak, a businesswoman and mountaineer, in 1985 after meeting at a party. They have two sons: Jay, co-head of Kotak811, and Dhawal, a senior program manager at Amazon. The family lives in Mumbai, balancing business and personal passions.

Controversies

RBI Disputes

In 2020, Uday clashed with the RBI over reducing his bank stake to 20%. He complied, lowering it to 30%, but the public dispute drew scrutiny. In 2024, the RBI’s ban on online onboarding due to IT risks sparked debates about governance, impacting the bank’s reputation.

Hindenburg Allegations

In 2024, Hindenburg Research linked Kotak Mahindra to offshore funds betting against the Adani Group, raising concerns about regulatory compliance. While no charges were proven, the allegations fueled discussions on X about the bank’s transparency.

Philanthropy

Through the Kotak Education Foundation, Uday supports education and livelihood programs for underprivileged communities. He funds schools, healthcare initiatives, and vocational training. As chancellor of BITS School of Management, he promotes academic excellence, impacting thousands in 2025.

Social Media Presence

Uday is active on X (@udaykotak), with over 1 million followers, sharing insights on banking, policy, and India’s economy. Posts in 2024 praised Indian housewives’ gold investments and outlined a 10-point economic plan. Kotak Mahindra’s official X (@KotakBankLtd) amplifies his vision.

Lesser-Known Facts

- Sitar Player: Trained in classical sitar during his youth.

- Cricket Star: Captained his school and college cricket teams.

- Injury Pivot: A 1979 cricket injury shifted his focus to finance.

- Goldman Sachs Deal: Ended a 14-year partnership in 2006 for $72 million.

- Hutchison Win: Turned a ₹2 crore investment into ₹1,019 crore by 2006.

- Modest Start: Began with a 300-square-foot office in Mumbai.

- Book Lover: Reads books on global finance giants like JP Morgan.

- Policy Influencer: Chaired SEBI’s 2017 corporate governance panel.

- Travel Enthusiast: Loves Japan’s cherry blossom season and Spain.

Current Status and Influence

As of July 2025, Uday Kotak holds a $15.87 billion net worth, ranking 11th in India, per Forbes. After stepping down as CEO in September 2023, he remains a non-executive director, guiding Kotak Mahindra Bank. His focus on digital banking, sustainability, and policy through B20 shapes India’s financial sector.

Conclusion

This Uday Kotak biography showcases a journey of grit and innovation. From a modest start to building a $68 billion banking empire, Uday Kotak overcame crises and controversies. His philanthropy and leadership inspire millions. In 2025, his vision continues to drive India’s financial future.